Understanding a Purchase Agreement

You’ve found a good buyer for your land and it’s time to move forward with the deal, now what? Some of you may remember the days where you could just drive over to the courthouse, meet with the buyer, and exchanged the signed deed for a check. Things have changed a little since then, but this is to protect both parties to ensure a safe transaction for everyone. Nowadays in North Carolina you need to close the transaction with a Real Estate Attorney, and he must understand how the deal is going to work.

That’s where the Purchase Agreement comes into play….

What is a Purchase Agreement?

A purchase agreement is a contract that lays out all the details of the land sale. It can be prepared by anyone, as long as it has all of the details the attorney needs to complete the transaction. We’ve completed hundreds of transactions with our purchase agreement.

The purchase agreement lets the attorney know all of the details about the transaction, a basic purchase agreement typically includes:

- Who the parties are in the transaction (the buyer and the seller)

- What piece of land is being sold

- The sales price

- How the buyer will pay for the purchase (Cash Sale or Financing)

- How much time the buyer has to complete their due diligence

- The closing date

- How to contact the buyer and seller

- How all of the fees associated with the transaction will be split up between the buyer and seller.

The Purchase Agreement DOES NOT Transfer Ownership of the Property!

The only way to transfer ownership is to sign a DEED, which is prepared by the attorney and signed at closing. The purchase agreement is simply an agreement to sell a property. It is a legally binding contract, so you should make sure all the details are correct before you sign. However, it does not transfer the property to the buyer.

We highly recommend that you WALK AWAY if someone wants to buy your property without signing a purchase agreement.

How Our Purchase Agreement Works

Now that you know what’s included in a purchase agreement, I’ll walk you through ours as an example.

Who’s Part of the Deal

The first thing our purchase agreement does is list the buyer and seller(s) included in the contract. This lets the attorney know everyone involved in the transaction, and that they all understand the terms of the sale.

What’s being sold?

Next, we specify the property being sold in the transaction. Since we’re dealing with vacant land, there may or may not be an address for the property. This section allows us to use address and/or some type of other description to make sure the attorney knows what parcel is being sold.

What’s the sale price, and how’s it being paid?

Next, we specify the sales price and how the land will be paid for. We always pay 100% cash for properties we purchase, so there is no contingency on getting approved for a loan.

What are the important dates?

The next thing our contract explains are the 2 important dates in the transaction: the Due Diligence end date and the Closing Date. The Due Diligence date is how long we have to complete all of our due diligence on the property. The buyer has the right to terminate the contract at any point during prior to the due diligence end date for any reason. This rarely happens on deals we’re purchasing, typically the only reason why we would terminate is if the attorney finds a title issue and the seller cannot legally sell the property.

How will title be transferred?

This section is the most complicated part of the contract. It explains that the attorney needs to prepare a warranty deed, the property can’t have any liens against it, and the sellers in the contract can legally sell the property.

It also states and that the seller won’t substantially change the property between the time the contract is signed and when the sale is closed. For example, you couldn’t put sign an agreement to sell your property, then sell the timber off the land before the closing date.

Who’s paying for the fee’s?

There are several fee’s that get charged for closing a real estate transaction, and each one can be paid by either the buyer or the seller. In a typical transaction, a portion of the fees are paid by each party, and the contract needs to explain that to the Attorney. Since we typically pay 100% of the closing costs, we keep it simple in our contract. We fill in #8 with this sentence: “BUYER to pay 100% of all closing costs, seller to net full purchase price”.

How can the contract be changed?

It’s important to explain how the contract can be changed if necessary. The only way our contract can be changed is if we have written agreement from everyone involved. This is another clause to help protect all parties in the transaction.

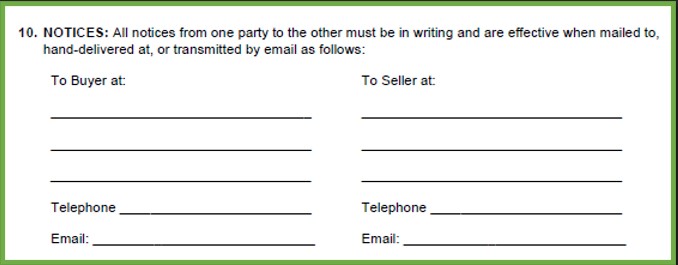

How can the parties be contacted?

The attorney will need to get in touch with the buyer and seller during the closing process. This section provides the attorney with a primary contact for each side of the transaction.

Any other terms?

If there is anything else the attorney needs to know about the transaction, we provide a section that can be completed. Most of the time we don’t have anything to add here.

Signatures

The last part of our contract is the effective date of the contract and the signatures of everyone involved. We typically fill out the effective date when we sign the contract since it can take days to get the sellers to sign if there are multiple people involved.

It’s not as scary as it sounds

“Purchase Agreement” may sound scary because it’s a legally binding contract, but in reality it’s a pretty simple document that protects everyone involved in a real estate transaction. We would never buy a property without one, and you probably shouldn’t either.

Ps. Don’t hesitate to shoot me an email or give me a call/text if you have more questions. (jennifer@landduo.com, 919-535-4858)

Pps. I’m not a lawyer, so this article should not be considered legal advice. If you have specific legal questions, you should consult with a qualified Real Estate Attorney.

-Jen